这次Pi币真的上线主网了!

来源:智堡

摘要

本次会议,美联储保持利率水平不变。

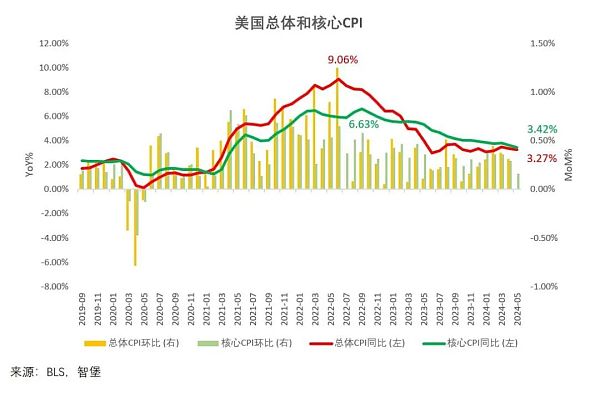

会议声明中仅有一处重大变化,即从上次会议的通胀下降的过程“缺乏进展”(a lack of further progress)变为了(modest further progress),以体现昨天刚刚公布的通胀数据(CPI)改善。

QT Taper本月落地。

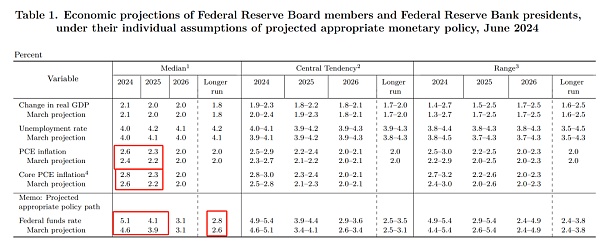

经济预测的整体变化不显著,其中值得注意的是通胀预测小幅上调,且由于5月PCE通胀数据已经公布为2.8%,故此次预测调整给人一种通胀改善已经达标的错觉。

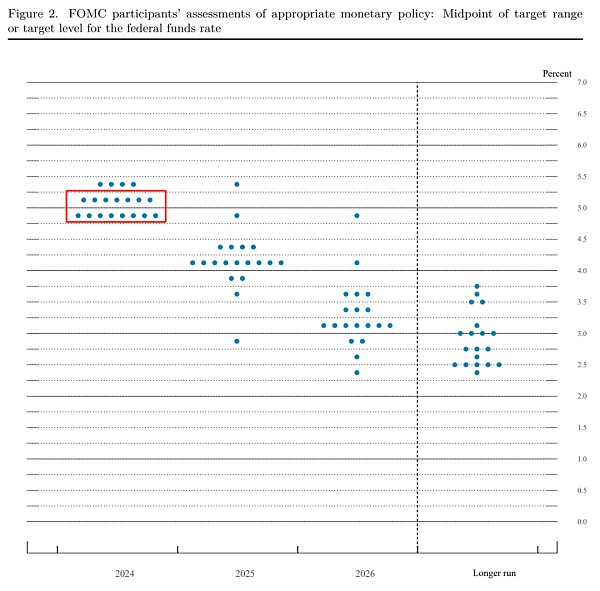

利率点阵图兑现了此前3月点阵图中的“上行风险”,有15位委员认为年内该降息,对降息一次还是两次存分歧。

长期利率预测连续两次季末会议上调,体现联储官员对长期利率中枢水平预期的微妙变化,但鲍威尔在发布会问答中淡化了这一变化的重要性。

发布会中的鸽派偏见感(Dovish Bias)明显弱化,主因依然是此前公布的CPI数据改变了发布会的观感和基调,通胀数据的改善让鲍威尔显得更加游刃有余。

美股市场保持了通胀数据公布后的涨势但随后小幅跳水,美债收益率及美元指数则在大跌后回升。

笔者认为,联储或许会在今年8月的杰克逊霍尔会议上明确下半年降息的条件,届时鲍威尔也将获得更多充分的通胀数据支持。

图:鲍威尔的紫色领带花纹变了,以体现modest further progress,从左至右为今年上半年的四次会议。

图:通胀数据的改善让鲍威尔松了一口气,也改变了整个发布会的基调与氛围。

声明原文(粗体为关键变化)

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

最近的指标表明,经济活动继续以稳健的步伐扩张。就业增长依然强劲,失业率保持低位。通货膨胀在过去一年中有所缓解,但仍处于高位。近几个月来,在实现委员会2%的通胀目标方面取得了适度的进一步进展。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

委员会力求在长时期内实现充分就业和2%的通胀目标。委员会判断,在过去一年中,实现就业目标和通胀目标的风险已趋于更好的平衡。经济前景不明朗,委员会仍高度关注通胀风险。

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

为支持其目标,委员会决定将联邦基金利率目标区间维持在5.25%-5.5%的区间不变。在考虑对联邦基金利率目标区间进行任何调整时,委员会将仔细评估收到的数据、不断变化的前景以及风险平衡。委员会预计,在对通胀率持续向2%迈进有更强的信心之前,不宜降息。此外,委员会将继续减持国债、机构债务和机构抵押贷款支持证券。委员会坚定地致力于将通胀率恢复到2%的目标。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在评估货币政策的适当立场时,委员会将继续监测所收到的信息对经济前景的影响。如果出现可能阻碍实现委员会目标的风险,委员会将准备酌情调整货币政策的立场。委员会的评估将考虑广泛的信息,包括对劳动力市场状况、通胀压力和通胀预期以及金融和国际发展的解读。

点阵图与经济预测

伴随通胀预测的小幅上调,利率预测同样上调。

长期利率预测继3月上调后,本次会议继续上调0.2%的水平。

年内降息1次(7位) vs 降息2次(8位)

一些有趣的发布会细节

再次重复风险平衡的管理姿态

免责声明:数字资产交易涉及重大风险,本资料不应作为投资决策依据,亦不应被解释为从事投资交易的建议。请确保充分了解所涉及的风险并谨慎投资。OKEx学院仅提供信息参考,不构成任何投资建议,用户一切投资行为与本站无关。

和全球数字资产投资者交流讨论

扫码加入OKEx社群

industry-frontier